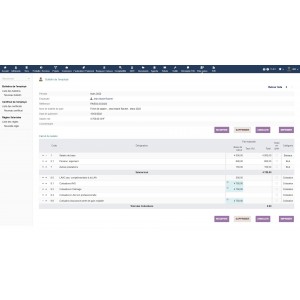

DOLIBARR PAYSLIP FOR SWITZERLAND:

Generate your Swiss Payslip on Dolibarr,

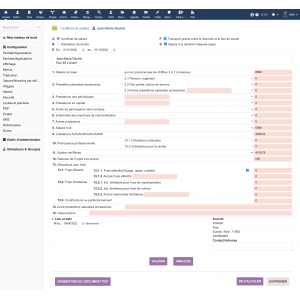

- Enter the gross salary of your employee,

- Introduce the salary and employer charges of your organization with the laws of your country.

- Enter the applicable rates in your country,

- Calculate the net taxable salary and the net salary to be paid.

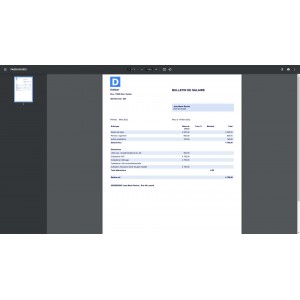

- Generate your Payslip on Dolibarr in PDF format.

DOLIBARR PAYSLIP FOR SWITZERLAND:

Generate your Swiss Payslip on Dolibarr,

- Enter the gross salary of your employee,

- Introduce the salary and employer charges of your organization with the laws of your country.

- Enter the applicable rates in your country,

- Calculate the net taxable salary and the net salary to be paid.

- Generate your Payslip on Dolibarr in PDF format.

- The first Module developed on Dolibarr which allows to generate Pay Slips.

- Compatible with the latest version of Dolibarr

- Compatible with the Multi Company module

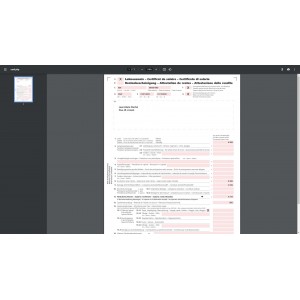

- Compliant with Swiss regulations.

Démonstration :

DEMONSTRATION OF DOLIBARR PAYROLL MODULE FOR SWITZERLAND

Login: demo

Password: demo

Specific References

No customer reviews for the moment.